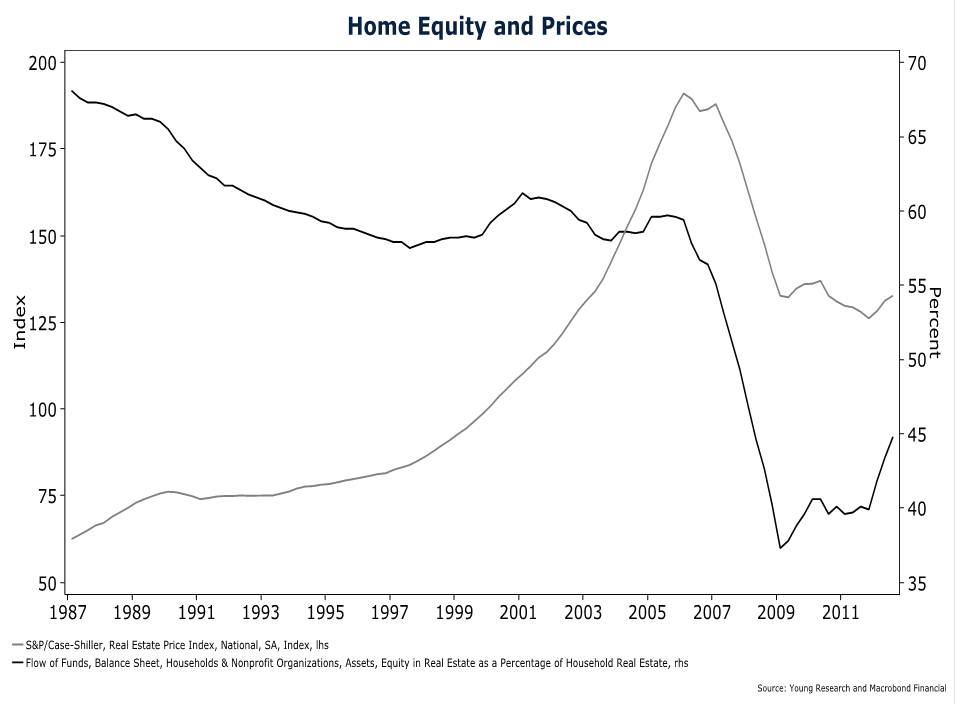

From the start of the Case-Shiller national price index in 1987 until the bottom of the financial crisis in 2009, Americans owned less and less of their homes. Homeowners were rapidly cashing out their home equity?they have owned less and less of their homes every year. It appears that trend may have ended with what looks like a bottom in 2009.

The chart below shows the percentage of equity Americans own in their homes (in black) and the prices of their homes. Even as prices increased, Americans drew down the equity in their homes. The declining trend of the equity line from 1987 to 2009 is a graphic illustration of Americans using their homes as piggy banks by taking out home equity loans and making smaller initial down payments on their home purchases. But since Americans? home equity bottomed in the first quarter of 2009 at 37.3%, they have added back 7.5 percentage points by the fourth quarter of 2012. That?s the most rapid addition of American home equity in history.

But in the same time period, the Case-Shiller Index of home prices (in grey) has only increased by .03 percent, not nearly enough to generate the increase in home equity seen in America during that time. The home equity gains have come the hard way, through foreclosures and the rapid slowing of home equity loan activity.

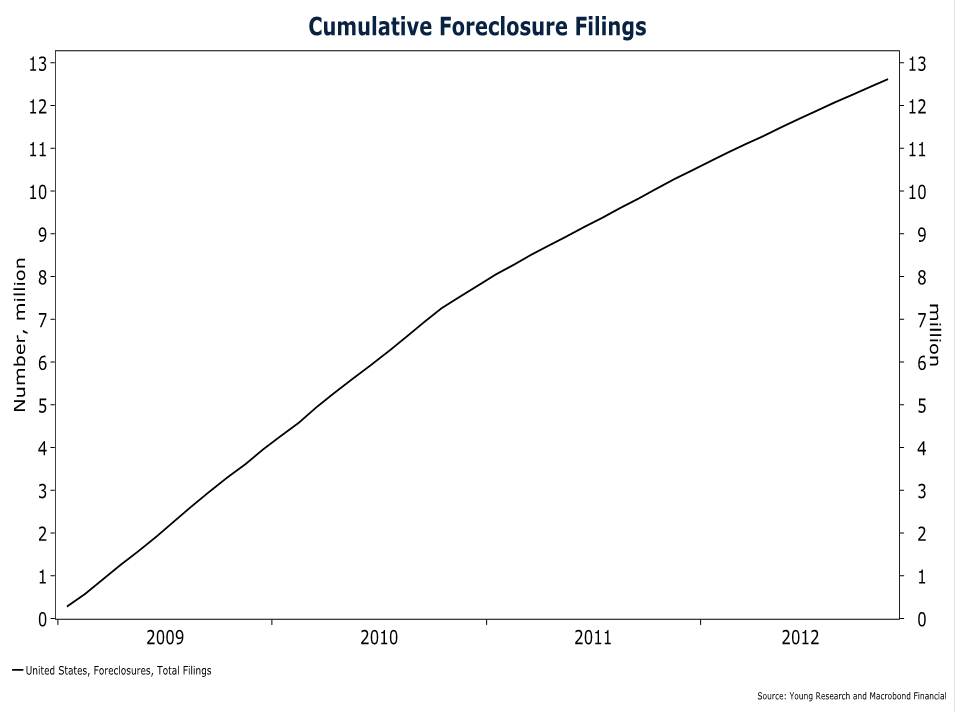

The chart below shows that since January 2009, 12.6 million foreclosures have been filed. Logically these loans tend to have the least amount of equity associated with them, so cleaning them up has gone a long way toward rebalancing the national home equity ratio.

But even more drastic is the reduction in the amount of home equity financing since the end of the housing bubble. You can see on the chart below that after the brief recession in 2001, home equity financing took off, reaching a quarterly peak of $107.6 billion in the fourth quarter of 2006.

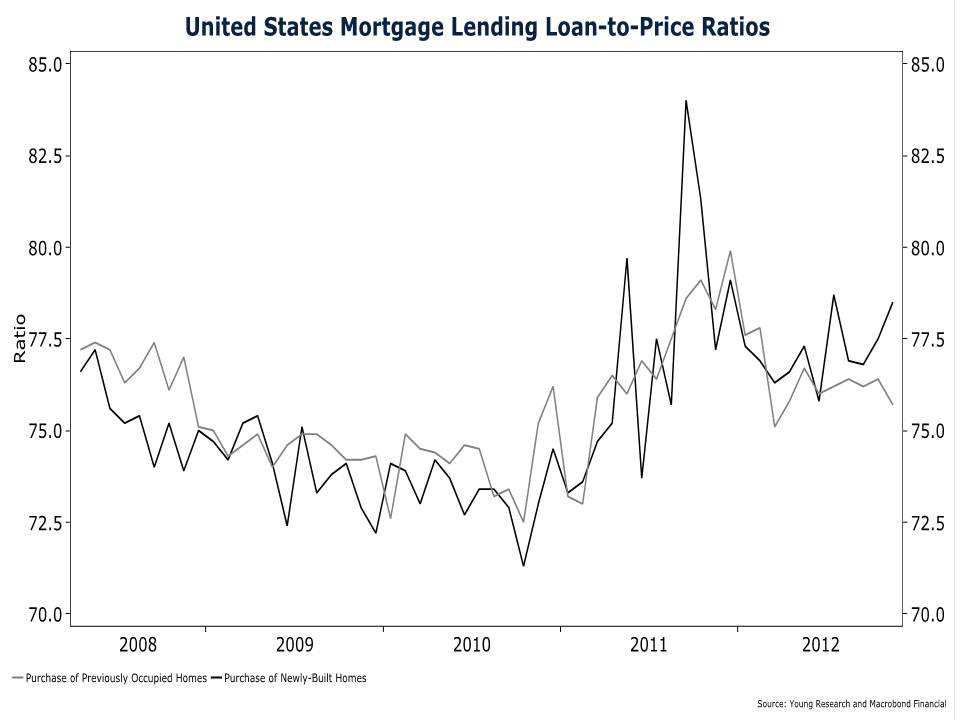

Counteracting the trends in home equity loan financing and foreclosures has been a reversal in the percentage paid down on initial home purchases since 2009. While loan-to-price ratios initially fell for new and used homes during the financial crisis, after 2010 those ratios started to climb once again. You can see on the chart below that lenders have been especially eager to finance the purchase of newly built homes (black line). The loan-to-price ratio on newly built homes is higher today than it was in January of 2008.

The increase in loan-to-price ratios generates risk for lenders, borrowers and investors. Navigating rapid market movements is not for the novice. In our premium strategy report, Young Research?s Global Investment Strategy, we have recommended the purchase of three real estate companies. Get these valuable names and more by joining us today.

Related Posts:

michael pineda charles taylor bruins boston bruins carl crawford mad cow disease rampart

No comments:

Post a Comment